Market Overview – Week 9/24

2024-03-01

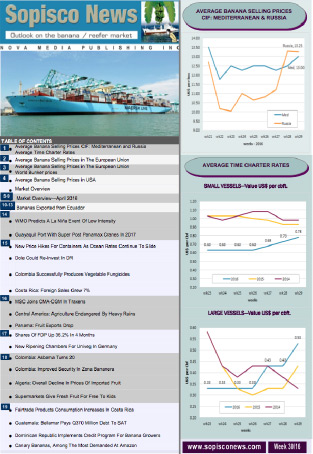

In Russia, the banana market has recently seen a downward price trend. The decline is primarily due to an oversupply of the fruit and a corresponding lack of demand. Most sales, determined by brand, volume, quality, and packaging, were priced in St Petersburg at approximately USD 18.30 to USD 19.40 per box CIF basis. However, the overall range of prices fluctuated between USD 17.20 and USD 20.50 CIF . The exchange rate was 1 USD, equal to 90.84 RUB during this period.

The prices for a 19 kg box of Ecuadorean bananas in the Mediterranean market varied between USD 16.0 and USD 19.0 per box CIF. The price range was influenced by brand, quality, region, volume, and packaging factors.

Algeria recorded the highest prices, with the cost per box reaching approximately USD 18.50 to USD 19.0 CIF. Conversely, Libya reported the lowest prices for Ecuadorean bananas, with sales averaging around USD 16.0 per box CIF. Central American bananas were even more affordable in Libya, ranging from USD 14.50 to USD 15.0 per box CIF.

One of the primary reasons for the observed price drop was the large volumes of fruit shipped to these regions. This information is corroborated by local traders who have noted an oversupply in the market.

In the Mersin Free Zone, the selling prices for re-exported Ecuadorean bananas exhibited significant variation, ranging from USD 16.50 to USD 19.00 per box. Several elements, including the brand, volume, quality, packing, and weight of the bananas, influenced this price range.

Contrastingly, Central American bananas were generally sold at a comparatively lower price, approximately USD 13.50 to USD 14.50 per box. Despite this general trend, it’s noteworthy that some brands did command slightly higher prices, indicating the potential influence of brand reputation and perceived quality on pricing or higher weight.

The exchange rate during this period was 1 USD = 31.36 Turkish Lira (TL). This rate is particularly significant given the continuous deterioration of the Turkish Lira against the US currency. Understanding this exchange rate is crucial for comprehending the local cost implications in Turkey.

The weakening of the Turkish Lira directly impacts the import of bananas for the domestic market. Moreover, it also affects the banana trade with neighbouring countries like Iran, Iraq, Syria, etc., especially considering the devaluation of their currencies. This economic interplay underscores the complex and multifaceted nature of regional international trade.

The Iranian market is experiencing a surge in demand for bananas, primarily due to the anticipation of Nawruz, the Persian New Year. This increased demand has led to a significant price rise over the past week.

Ecuadorian bananas, in particular, have seen a price increase, reaching 80,000-85,000 Toman per kg. This price hike can be attributed to low availability, high demand, and slow operations in clearing cargo at the Iran and Turkish border.

Meanwhile, Indian bananas have been priced at 60,000-70,000 Toman per kg, with bananas from the Philippines trading at similar levels. Notably, the price of a 13.50 kg box of Indian bananas reached USD 10.75-11.00 CIF Bandar Abbas. One of the contributing factors to this higher price is the increase in freight, which has reached nearly USD 4,000 per reefer FEU.

However, local traders anticipate a potential drop in banana prices in the coming week. This prediction is based on the high volumes of fruit expected to be shipped from India.

It’s important to note that the current exchange rate is 1 USD = 58,000-59,000 IRT (Iranian Toman).

prices in the Ecuadorean Spot Market wehere mainly at USD 9.50-10.50 per box during the week for the fruit only with peaks up to USD 11.0 per box during the week depending on quality, day of the week and area. where the fruit was purchased

On the Reefer Market there were no spot fixtures for bananas during the week. Some vessels were fixed for fish trade, with more large ships reported in route to the South Atlantic of Falklands fishing grounds. Another vessel that had previously loaded bananas in Ecuador and discharged in Algeria and Tunisia is scheduled to take a cargo of pasta from Mersin to Venezuela.

Some smaller reefers are reported to be transporting foodstuff from Mersin to Japan.

Several vessels from New Zealand are expected to be employed in the Kiwi trade.

And there are vessels currently employed in the Chile grape season for the USA will be redirected to New Zealand after mid-April when imports of grapes in the USA come to a halt.

Time Charter Rates for large vessels reached US Cents 90-95 per cbft per month, with almost the same level for the smaller vessels.

Bunker Prices:

VLSFO MGO

Panama Canal $594.00 -

Gibraltar $624.00 $873.00

Rotterdam $582.00 $782.50