Market Overview – Week 08/2024

2024-02-23

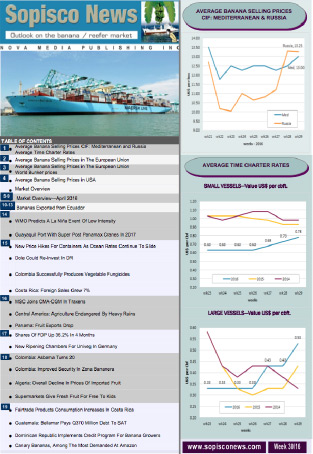

Banana selling prices in St Petersburg ranged from USD 20.10 to 22.25 per box CIF. Approximately 1.79 million boxes were discharged in week 8, and around 2.25 million are expected for week 9. The exchange rate was 1 USD = 92.44 RUB.

The Russian Federation had a long weekend as Friday, February 23rd, was a national holiday, the Public Life Defender of the Fatherland Day. Most schools, banks, and official buildings were closed on this day.

After the ban on banana imports from five Ecuadorian companies was lifted, all discharge and custom-clear operations were expected to proceed smoothly. However, cold temperatures during the week delayed operations in the St Petersburg port. The weather improved later in the week.

In the Mediterranean, prices for Ecuadorean bananas were USD 17.0-18.0 per box CIF, depending on the brand, volume, packing, and region, with peaks up to USD 20.0 in Libya. In Algeria, prices were around USD 17.0 per box CIF, which only allowed importers to break even without any gain.

Bananas from Central America sold for around USD 2.0 less per box in almost all regions.

Prices in the Free Zone of Mersin were higher than the previous week, around USD 17.0-18.0 per box, and up to USD 18.50 on occasions for the re-exported bananas from Ecuador. The Central American fruit sold for around USD 14.0-15.0 per box or less. The exchange rate was 1 USD = 31.008 TL.

During the week, sales in the Iranian market were good; demand was satisfactory, and prices fluctuated between 65,000-75,000 Toman per kg for Ecuadorian bananas and 60,000-63,000 Toman for Indian bananas.

The 13.50 kg box of Indian bananas discharged at Bandar Abbas was USD 9.25-9.50 CIF. The freight rate increased compared to the past 2-3 weeks, reaching USD 4,000 per reefer FEU.

Sales of bananas improved in the domestic market and are expected to increase in volume in anticipation of Nowruz, the Iranian New Year, 2024, which starts in Tehran on March 20. The dollar exchange rate increased slightly, reaching 55,000-57,000 Toman.

Prices in the Ecuadorian Spot Market were mainly around USD 9.50-10.50 per box for the fruit only, although there were also slightly lower prices depending on quality and areas where the fruit was purchased.

There was abundant rain during the week in the three principal banana-producing regions of Los Rios, Guayas, and El Oro. However, due to the excellent drainage system, no farms flooded, and so far, the soil in most plantations is not saturated, although there were rivers that were at their maximum levels due to the heavy rains of the past days.

Demand in the Spot market increased with Extraban, one of the prominent traders in the Middle East, resuming buying during the week after the company reportedly discharged the bananas loaded in Ecuador in week 46 after 80 days of travel and is downloading week 47 after 90 days of travel on its new route. The vessels directed to ports in the UAE or Umm Qasr in Iraq are obliged to take the Cape Hope route instead of crossing the Suez Canal to avoid the Red Sea afflicted by warlike activities. Shipments for Russia increased too; last week’s delayed Cool Carriers vessel of the liner service to St. Petersburg arrived at Puerto Bolivar to load from Monday 19 to Wednesday 21 and then proceeded to Guayaquil to load Thursday 22 and Friday 23.

Reportedly, many growers started cutting their fruit from Wednesday to Saturday for higher prices. Heavy rains during the week with pauses allowed the soil of the farms to drain naturally.

Despite the Niño Phenomenon, it has been an “Invierno bananero” or a winter favorable for the banana industry with no floods in areas like Vinces, Baba, and Pueblo Viejo, as it often happens in the rainy season in Ecuador.

No banana fixtures were recorded during the week. However, there were several fixtures for the fish trade, and many ships are reported to be now employed in the squid season on the Southern Atlantic off Argentina and the Falkland.

At least 4-5 ships are programmed to load citrus in Argentina for St Petersburg, and the New Zealand kiwi season, which will require many ships, is expected to start in advance.

The Time Charter rate for large ships increased to US cents 95-100 per cbft per month and around US cents 90-95 per cbft per month for smaller vessels. Rates are expected to go further up.

Bunker Prices:

VLSFO MGO

Panama Canal $606.00 -

Gibraltar $617.50 $876.00

Rotterdam $580.00 $805.50